Mainspring Energy Lands $150M Deal To Deploy Its Linear Generators With NextEra

Mainspring Energy Lands $150M Deal To Deploy Its Linear Generators With NextEra

Over the past decade, Mainspring Energy has been at work on a novel “linear generator” that it says can provide on-site electricity with lower emissions than fossil-fueled engines and microturbines, and greater flexibility than fuel cells.

On Tuesday, Mainspring’s vision garnered a vote of confidence from U.S. utility and renewables giant NextEra in the form of a $150 million agreement with its business services arm NextEra Energy Resources to purchase, finance and deploy Mainspring’s devices across the country.

Mainspring started testing its linear generators last summer with an unnamed national supermarket chain, which has agreed to expand its use to up to 30 grocery stores, according to Tuesday’s announcement. The Menlo Park, Calif.-based startup, formerly called EtaGen, has also shipped products to big-box retailers and utility customers, and it is in discussions with other Fortune 500 companies.

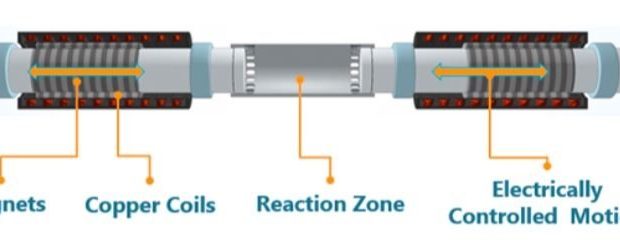

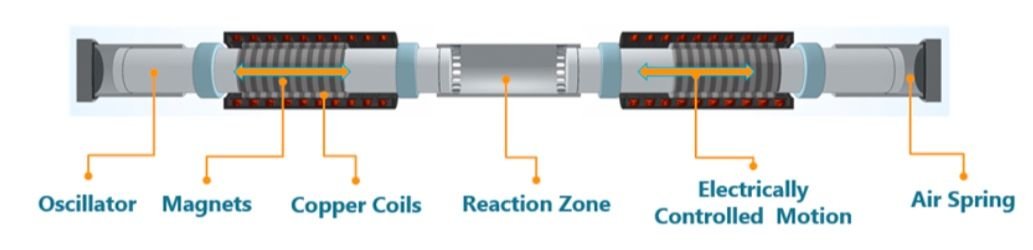

The core concept behind Mainspring’s generator — capturing the back-and-forth motion of pistons, or oscillators in Mainspring’s terminology, to generate energy — is shared by a wide class of devices, ranging from Stirling engines to linear alternators and motors. But Mainspring’s system differs in several key ways from the variety of similar technologies developed over the decades, CEO Shannon Miller said in an interview.

“It’s a full systems integration: making sure the emissions are low, making sure the efficiency is high, making sure we have the controls in place to use different fuels,” said Miller, a former mechanical engineer at Tesla who developed the idea behind Mainspring’s technology at Stanford University with company co-founders Matt Svrcek and Adam Simpson.

Low-emissions, fuel-flexible, dispatchable on-site power

One of the key innovations is Mainspring’s use of “air springs” and an “air-bearing system” as cushions of air that hold the magnet-equipped oscillators in place within the structure that captures their back-and-forth motion to generate electricity. Using air instead of mechanical bearings or oil reduces friction and does away with the key mechanical points of failure that have challenged other linear generator designs, said Miller.

In simple terms, “it’s like an air hockey table that you’ve wrapped around into a tube,” Miller said. In terms of its sophistication, getting this air-based system to work smoothly and reliably has required “a lot of good engineering,” helped along by research and development funding. Mainspring has raised $133 million to date from investors including Microsoft co-founder Bill Gates, Khosla Ventures, utility AEP and the venture arms of oil giant Statoil and energy company Centrica.

Mainspring has also tapped advanced power electronics developed for electric vehicles, solar inverters and other digital power conversion and control technologies to “adjust the position of the floating tubes very precisely,” she said, “down to the thickness of a piece of paper.”

This makes its generators “dispatchable,” that is, able to adjust to changes in the electrical loads they’re supporting or rising and falling levels of energy on the grids they’re connected to, Miller said. That’s a differentiator between Mainspring’s devices and typical fuel cells, which are designed to run at a steady output.

That same control flexibility also gives Mainspring the ability to “move the oscillators to a different position for different fuels” with different energetic characteristics, she said. That will allow its devices to convert from using natural gas, which emits carbon dioxide when converted into energy, to fuels that are carbon-neutral such as biomethane or hydrogen as they become more widely available, without significant changes in how they’re designed or operated.

Finally, Mainspring’s generators can operate with almost no emissions of nitrous oxides, or NOx, she said. That’s because the generators combine fuels with oxygen in a central reaction cylinder between their two oscillators, and then use the rising pressure as those two oscillators are pushed back inward by the air springs at either end to create a “uniform and flameless reaction” to release energy.

That’s different than using electrical sparks to ignite fuel-air mixes, as most fossil-fueled engines do, and again requires fine-tuned engineering to operate effectively. But the end result is a generator that can meet California’s South Coast Air Quality Management District’s stringent NOx emissions standards for on-site power and uses fuel more efficiently to reduce carbon dioxide emissions compared to engines, according to Miller.

Flexible fuels versus clean energy and batteries

Mainspring hasn’t disclosed the upfront cost of its 250-kilowatt generators or made direct comparisons to engines or fuel cells. But Miller pointed to the technology’s flexibility as a key selling point for customers including NextEra.

The $150 million deal includes financing structures akin to power-purchase agreements to allow customers to use Mainspring’s units to replace on-site load served by the grid, as well as provide reliable backup power during grid outages. This type of energy-as-a-service model is increasingly being used to reduce both upfront costs and operational complexity for customers, with microgrid developers including Enchanted Rock and Scale Microgrid Solutions and energy services giants like Schneider Electric and Siemens forming joint ventures with investors to bring them to market.

As one of the world’s largest wind and solar power owners, NextEra is also interested in technologies that can “dispatch the way we do, ramp up and down, and switch to different fuels” to provide flexibility to integrate increasing levels of intermittent renewables on the grid, according to Miller. A new white paper from Guidehouse Insights (PDF) highlights the potential for technologies like Mainspring’s to help integrate large-scale and distributed renewables, with a projected $38 billion global market over the next five years.

While batteries are increasingly being paired with wind and solar, “solar and batteries aren’t enough to get us to zero carbon from a cost perspective,” Miller said. “We need renewable fuels to help support that.”

Beyond these long-term decarbonization challenges, California is facing the immediate problem of how to find alternatives to diesel generators to back up communities that are facing multiday wildfire-prevention grid outages, she said. Solar and batteries on their own cost too much to reliably provide megawatts of power for days at a time, but they could be part of a microgrid centered on generators that can move from fossil to low- or zero-carbon substitute fuels over time, she said.

Bill Magavern, policy director for the California-based nonprofit Coalition for Clean Air, highlighted the challenge California faces in simultaneously striving to meet its decarbonization goals and provide reliable power.

“We definitely want to get to zero emissions as soon as possible,” he said. “But we also need to get away from dirty diesel. And therefore, we welcome technologies that are much…cleaner than diesel, even if they’re not at absolute zero emissions. We especially welcome those technologies if they have the potential to get to zero emissions in the future.”