California Faces Battle Over Budgets for Backup Battery Incentives

California Faces Battle Over Budgets for Backup Battery Incentives

Should California reserve hundreds of millions of dollars in battery incentives for customers at the highest risk of being harmed by wildfire-prevention blackouts? Or should it or share the money with low-income and disadvantaged communities that will otherwise be denied support for projects?

That’s the question facing the California Public Utilities Commission this week as it considers an energy storage industry request to modify the state’s Self-Generation Incentive Program (SGIP) to shift money from the former group to the latter.

The petition from the California Energy Storage Association asks the CPUC to transfer $310 million in SGIP funds to projects in low-income and disadvantaged communities that otherwise won’t get state incentives. This would “support shovel-ready projects that provide economic stimulus” amid a COVID-19 pandemic-driven economic downturn, CESA wrote.

The energy storage industry’s proposal would take $150 million from the roughly $460 million remaining for a particular class of customers the CPUC has designated for special treatment — a highly lucrative $1-per-watt-hour incentive for what are called “equity-resiliency” projects. Those are projects serving people who are not only low-income or medically vulnerable but also reside in zones subject to wildfires or fire-prevention blackouts.

If the funding were made available to a broader group of potential customers, battery vendors including Tesla, Engie and Stem may be able to serve more customers and do more business.

The CPUC has argued that the budget should be retained for the state’s most vulnerable customers.

California program “set up for failure”?

Late last year, the CPUC directed two-thirds of SGIP’s $830 million budget toward the “equity-resiliency” customers after blackouts left millions of California residents without power, most of them served by bankrupt utility Pacific Gas & Electric. PG&E warns it may have to continue the blackouts for years to come in order to prevent more deadly wildfires.

But the decision has a downside, reducing the pool of funding for low-income and disadvantaged customers who quality for SGIP’s equity budget but reside outside the designated wildfire and blackout threat zones.

Those customers are eligible for a still-generous incentive worth 85 cents per watt-hour, but many have found it challenging to qualify for incentives under the CPUC’s new rules, energy storage vendors say.

Even in California, incentives are still needed for energy storage projects to make economic sense in most cases.

California Sen. Scott Wiener, author of the 2018 law that increased SGIP’s budget through 2024, wrote the CPUC a scathing letter in January, accusing it of undermining the program by setting up the special equity-resiliency category “so restrictive” that it will “almost certainly be under-utilized.”

Wiener repeated those criticisms in a Wednesday interview, noting that his bill allocated 60 percent of SGIP funds for low-income customers.

For the CPUC “to instead say that over 63 percent [of the budget] is restricted to only a tiny number of census tracts is setting it up for failure,” he said. “It violates the intent of the legislature.”

SGIP applications show funding imbalances

Applications for the SGIP program opened in May, and results to date appear to bear out worries from battery companies that many projects outside the equity-resiliency category won’t be able to secure funding.

Specifically, the nonresidential storage equity budget — meant for schools, hospitals, government buildings and private businesses in specified disadvantaged census tracts across the state — saw its existing $53 million budget oversubscribed by $300 million.

Those “waitlisted” projects won’t receive state support unless the CPUC approves a shift in funds. That’s despite the fact that many of those projects would serve customers who are likely to experience fire-prevention blackouts, CESA argued in its recent petition.

Those include a hospital and a wastewater treatment plant within a mile of high-fire-threat districts that don’t qualify for the enhanced incentive, plus several schools that experienced outages last year but aren’t “designated as a community resource or cooling center” under the CPUC’s “critical facility” criteria.

The equity-resiliency program’s current $100 million budget was fully subscribed and has an additional $50 million in waitlisted projects. But the CPUC has reserved $512 million for this category, which would leave about $460 million after clearing those waitlisted projects when those funds become available through a decision expected in the next month or so.

CESA’s petition asks the CPUC to move $160 million from a large-scale energy storage category that still has $262 million left after seeing only $35 million in applications. The remaining $150 million would come from the equity-resiliency budget, leaving “sufficient funds” to support more applicants, CESA wrote.

Weighing the risks of underfunding projects

The CPUC sees the equity-resiliency funding as a success thus far. CPUC President Marybel Batjer told the California Senate Energy Committee last week that the equity-resiliency budget has enrolled more than 2,000 people and cited its waitlist as a sign of continued growth.

“That number, given all the challenges and outreach that we have, and reaching out to a new batch of customers in a very short period of time, is really quite astonishing,” Edward Randolph, CPUC deputy executive director for energy and climate policy, said in a recent interview. “It shows that the storage industry…[is] able to go out and find customers in need and projects that are eligible.”

Grid Alternatives, a nonprofit that installs solar and batteries for low-income California residents, also opposes shifting money from the equity-resiliency budget. Residential customers reliant on them are “medically vulnerable, low-income, or rely on well water, and are located in communities that are most impacted by wildfires and shutoffs,” Elise Hunter, the group’s policy and regulatory affairs director, wrote in an email. “Any attempts to remove funding for these customers is not warranted, especially when there is already a waitlist.”

But Ted Ko, vice president of policy and regulatory affairs for energy storage provider Stem, said that past experience with SGIP indicates it’s unlikely that enough equity-resiliency customers will apply in the weeks and months ahead to deplete the hundreds of millions of dollars earmarked for them.

SGIP has traditionally seen far more applications than available funding for categories that offer the right combination of incentives and participation rules, he said. At the same time, categories that don’t offer lucrative enough incentives tend to be undersubscribed, as with this year’s large-scale storage category.

“You may see a few more trickle in over the next month or so by July when the new budget is open,” he said. “But it’s still going to be a fraction of what’s available.”

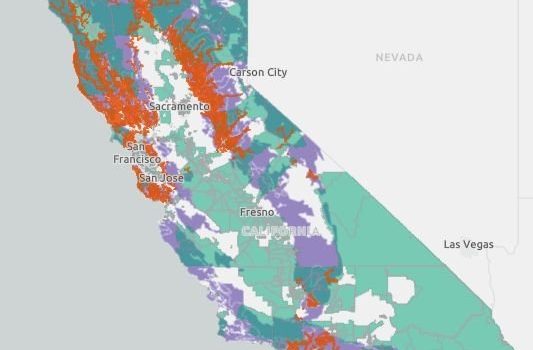

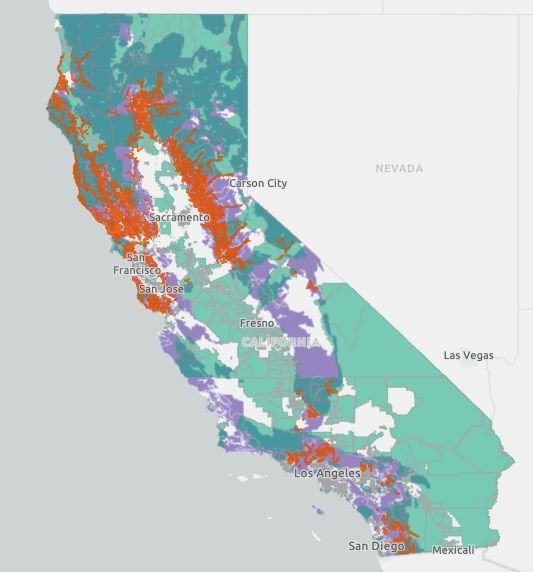

(This online map shows the parts of California that are eligible for SGIP incentive categories, with high-fire-threat districts in purple, areas with two or more blackouts last year in orange, low-income and disadvantaged community census tracts in light green, and areas where high-fire-threat districts and disadvantaged community census tracts overlap in dark green.)