Advanced Nuclear Fission’s Role in the Energy Transition

Advanced Nuclear Fission’s Role in the Energy Transition

In May, the US Department of Energy launched the $230 million Advanced Nuclear Reactor Demonstration Program. Through a public/private collaboration, two reactors will be deployed in the next five to seven years. This, along with federal support for advanced nuclear, shows how serious the US is about adopting the next generation of technologies for its clean energy strategy.

Today, nuclear power supplies ~11% of global electricity needs and has, over its roughly 50 to 60 year lifetime, reduced CO2 emissions by over 60 gigatons. Opportunities for abating CO2 are huge, however nuclear progress is stalling. If the world energy system hopes to stay on the current sustainable track, the International Energy Agency (IEA) projects that the annual rate of additions to capacity needs to double.

This stalling is largely attributed to longstanding global opposition from both the public and policymakers which has arisen, understandably, from previous harmful mistakes made in the nuclear era. Key market hurdles include:

- Unclear long-term management strategy of spent fuel from nuclear reactors

- Potential linkage between nuclear power and military applications (proliferation)

- Adverse public health/environmental effects due to severe accidents

- Concerns on high capital costs and historical cost overruns

Without the necessary innovation to address these concerns, nuclear power in advanced economies could fall by two thirds by 2040; however, if done correctly, advanced nuclear could play a key role in the 2050 decarbonization targets.

Same Name, Different Technology

Advanced nuclear is looking to address the hurdles listed above head on. Emerging advanced designs drastically increase safety and do so to a point where systems will require little or no operational personnel on site. These new systems can provide:

- Competitive economics when compared to today’s renewables projects and carbon-based baseload power plants

- The potential to tap in to- and make use of- spent nuclear fuel

- New characteristics which are desirable for a range of emerging markets such as hydrogen, thermal decarbonization and long-duration energy storage.

Advanced nuclear has, over the last 20 years, struggled to make a true and lasting impact on the market. However, an increase in private investor engagement combined with innovations in manufacturing and the modernization of the National Regulatory Standards (NRC) licensing process have pushed the advanced nuclear needle closer towards commercialization.

Advanced nuclear largely consists of two major system categories:

- Generation III+

- Generation IV.

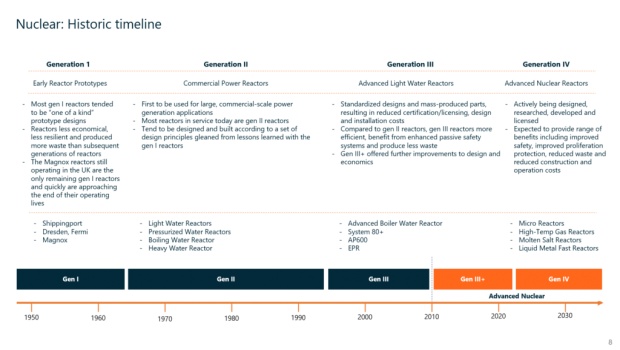

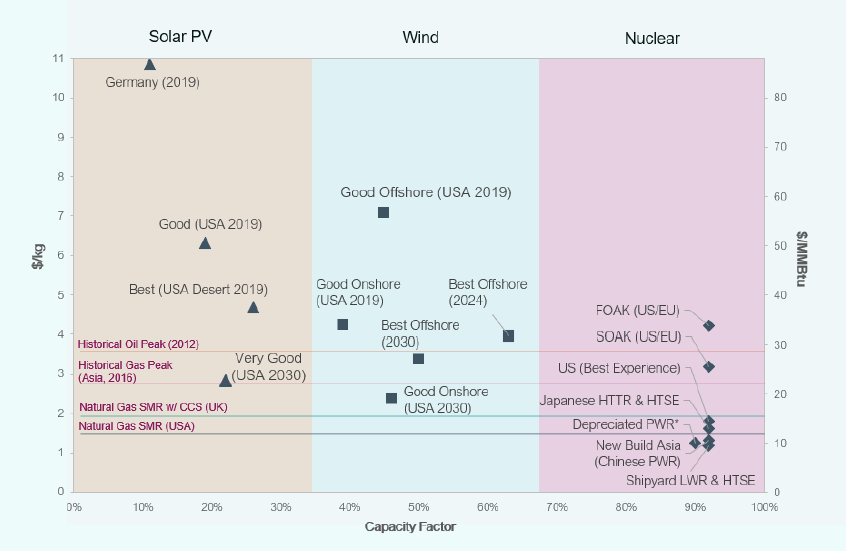

Generation III+ largely makes use of existing water reactor designs but uses standardized designs and mass-produced parts to enhance passive safety and produce less waste. Generation IV systems, currently in the design phase, will use new reaction designs and are expected to provide a range of benefits including improved safety, improved proliferation protection, reduced waste and lowered construction and operation costs. The figure below highlights the development nuclear has gone through over the past 70 years.

Key technology differentiators include:

- What coolants can be used, other than light water

- How a system operates at normal atmospheric pressure

- How physics is used in addition to engineering to keep reactors safe

- How reactors can be made small enough (from 3 to 250 MW) to be mass-produced in factories, significantly slashing construction costs and saving time.

Near-Term Deployment: Small Modular Light Water Reactors (SMR)

The first advanced reactors coming to market will be Gen III advanced light water reactors, which sit in the 20MW-300MW range. Many incumbent nuclear players (Westinghouse, CNNC, GE-Hitachi) and a handful of start-up innovators, such as Nuscale Power, are focusing on iterating light water reactors using previous experience in medium and large-scale water reactors to reduce size, improve standardization and increase the use of spent fuel. In the offshore market, Russian-based Rosatom put the first floating system into operation this January which has a rated capacity of 50MW.

Nuscale Power is currently working with industrial partners to commercialize the first on-land SMR and has raised $37 million to deploy their system by 2025. Their solution is the world’s first small light water reactor to undergo design certification review by the U.S. Nuclear Regulatory Commission (NRC). Nuscale’s early work with the NRC has been key in helping modernize the licensing process by reducing many of the existing certification pain points. Their efforts have opened the floodgates for other private innovators to benefit from shorter licensing timelines and the company is actively working with licensers in the Czech Republic and Ukraine, among other countries.

Small light water reactors are likely to be used for electrical generation, district heating, water desalination and other process heat applications. NuScale’s first commercial customer is Utah Associated Municipal Power Systems (UAMPS), where a 720 MW system will be used for power generation and other applications by 2025.

Near-Term Deployment: Microreactors

More recently, a wave of innovators developing microreactors have received attention in the industry. These Gen IV systems sit in the 1-20 MW range and have trimmed a lot of the unnecessary fat off previous nuclear designs. By capitalizing on enhanced modular construction and design innovation, systems can reduce the number of parts required, ultimately increasing system simplicity. This streamlined approach results in cheaper systems and shorter licensing timelines. Innovator Oklo, which is developing a 1.5MW fast reactor, was founded in 2013 and hopes to have a unit operational by 2023. This March, Oklo submitted the industry’s first combined license application for a non-light water advanced reactor. Based on its simple and inherently safe design, Oklo pursued a custom combined license application which was under 600 pages, compared to NuScale’s application, which was 12,000 pages.

The “Tesla” approach to iterative, lean system design has been picked up by other key innovators in the segment including U-Battery and Ultra Safe Nuclear Corporate, the latter of which is looking to commercialize its 5MW microreactors within the next 5 years.

The relatively tiny size of the reactor means systems are well built to compete in the remote power market, competing competitively with diesel and bunker oil. Players are mainly looking to capitalize on a very low-levelized cost of energy via structuring as independent power producers, offering long-term power purchase agreements to build and operate new systems.

Medium-Term Deployment: Molten Salt Reactors

Another strong technology cluster is the Generation IV molten salt reactors. These systems range between 30-500MW in size and have great appeal, in part, due to the availability of high-temperature process heat, operating above 600 degrees (around 300 degrees higher than conventional light water reactors). As a result, these reactors have the potential for high-temperature green hydrogen production, thermal storage and other industrial heat processes.

Terrestrial Energy is developing a 200MWe Integral Molten Salt Reactor, which uses molten salt fuel instead of conventional solid fuel. Their first plants are expected to come online in the 2020s and they are looking for their marketable units to be generating energy at under 4.5 cents per KWh. The markets will include electricity production, as well as working with industrial players who require high temperature heat.

Industrial heating systems account for around 50% of total system capital costs, therefore opting for safe nuclear systems may be useful as carbon-based fuels are phased out.

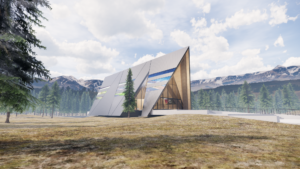

The growing hydrogen sector is also a big market opportunity for nuclear. Lucid Catalyst‘s graph (above) highlights the competitiveness of the nuclear-based renewable generation of hydrogen on a cost and capacity basis. This highlights opportunities for players such as Terrestrial, Kairos Power, Moltex Energy and others to have a key economical differentiator in the growing hydrogen market.

Worth watching: Gen IV Fast Reactors

These can range in size (from Oklo’s 1.5MW to Westinghouse’s 450Mw lead cooled reactor) and have the potential to significantly increase both efficiency and safety, plus, they can use a much higher volume of spent nuclear fuel. Their design means that they require more fuel initially, but have very long run cycles and are well-suited to a lower OPEX model. As of today, there are no Versatile Test Reactors (VTR) for the testing of fast reactors operational in the US and they are currently limited to Russia (Bor-60). However, TerraPower and GE-Hitachi are working with the US Department of Energy to construct a VTR which is expected to be completed by 2022. Key players to note in this segment are:

- TerraPower – Commercializing a sodium-cooled Traveling Wave fast reactor and a Molten chloride fast reactor

- Arc Nuclear – Commercializing a 100MW sodium-cooled fast reactor

- X-Energy – Commercializing two reactors, Xe-Mobile, a micro reactor, and Xe-100 (high-temperature, gas-cooled reactor)

- Starcore Nuclear – Commercializing a 20 MWe high-temperature gas-cooled fast reactor.

What Needs to Change?

While huge progress has been made over the past 10 years, nuclear still suffers from massive social acceptance issues due to the mistakes of previous technologies. While Canada, UK, China, Russia and the Unites States are progressing the market, advanced nuclear players need to ensure that the safety of newer systems remains an integral part of the industry.

Proliferation concerns for nuclear waste usage is another core aspect of why public perception against nuclear power remains. Outside of expensive, geological storage, there has been little in the way of novel solutions for better nuclear waste management. As transportation is largely illegal, many governments keep spent nuclear fuel onsite. The cost of disposing existing nuclear waste from commercial reactors in the United States has been estimated at $92 billion. Further innovation is needed to allow players like Moltex and TerraPower to reuse spent nuclear fuel and some legal hurdles need to be resolved to allow for the reuse of nuclear waste if a market is going to exist.