Will Safer Batteries Finally Take Over the Home Storage Market?

Will Safer Batteries Finally Take Over the Home Storage Market?

If the U.S. converts to a carbon-free grid, millions of homeowners may wish to generate and store their own solar power. Companies are already jockeying over that potentially massive market — and the commercial contest revolves around safety.

Tesla and LG Chem currently dominate the U.S. home battery market. Both use the lithium nickel-manganese-cobalt oxide (NMC) chemistry favored by the electric vehicle industry. In cars, the goal is to pack as much energy into as little space as possible. That comes with a tradeoff: the potential for cells to heat up and kick off a chain reaction that can end with fire and, in enclosed spaces, explosion.

Such calamities are extremely rare. But, in December, LG Chem (recently rebranded as LG Energy Solution) recalled an unknown number of battery packs after five “thermal events” caused property damage in U.S. homes. The company insists its newer products improved safety, and indeed launched a new, more powerful home model shortly after the recall.

“LG has a lot of batteries out there and recalls happen,” said Linh Tran, director of sales for that company’s home battery division. “LG responded the way that you would want a manufacturer to respond.”

But the umbrella term “lithium-ion battery” covers a range of chemistries. A vocal cohort of startups has argued for years that homeowners would be better off with less fire-prone varieties. The favorite contender in this category is lithium-iron-phosphate (LFP), which has an established safety record.

“We chose LFP since the beginning because of its safety properties,” said Danny Lu, senior vice president at grid battery company Powin Energy. “It’s much less flammable, and it takes a much higher temperature to reach thermal runaway than NMC does.”

Thermal runaway is the process in which one battery cell fails and heats up enough to kick off failure in a neighboring cell. Pretty soon a whole rack of batteries can be heating up from the inside, causing fires or worse.

That’s a concern for the kinds of large-scale power plants that Powin recently raised $100 million to supply. But large battery plants are designed with special safeguards to prevent thermal runaway from inflicting massive damage, and typically operate remotely, with no staff onsite. Homes with battery packs, by contrast, lack industrial-grade fire safety tools, and are occupied by humans and pets who would be threatened by a fire.

LFP used to be commercially disadvantaged against NMC, because the chemistry cost more and took up more space. Now, costs have fallen into competitive territory and energy density has improved, making converts of some former NMC fans. After years in which the exhortations of LFP aficionados failed to move the market, trends may be shifting in their favor.

“The price of LFP has come down significantly,” said Catherine Von Burg, CEO of California-based LFP manufacturer SimpliPhi Power. “There’s going to be parity [with NMC]. Truthfully, we’re almost there.”

Lower price came with risks

Fans and detractors of NMC agree it started with a major cost advantage. That’s because it rode the tremendous growth of the electric vehicle industry.

Home energy storage is still a new and relatively expensive product category. Americans installed around 7,000 home batteries per quarter last year, according to energy research firm Wood Mackenzie. That same year, Americans bought nearly 300,000 electric cars, according to Platts.

In the early days, using LFP would have meant roughly doubling the cost of batteries and taking up extra space for a home installation, said Aric Saunders, EVP for sales and marketing at home battery startup ElectrIQ. ElectrIQ designed its first two product generations around NMC batteries.

“Price was a big hurdle for the industry — we were trying to open up a marketplace,” he said.

And while a contingent of companies proclaimed the merits of LFP and relative danger of NMC, the safety concerns largely existed on paper. Lithium-ion batteries had become commonplace in phones and laptops, and were showing up in people’s garages in electric vehicles. Why not also in a box on the wall?

“Considering the number of lithium-ion batteries out there and the number of fire incidents that have been reported, the risk is pretty low,” said Apurba Sakti, research scientist at the MIT Energy Initiative. Researchers have estimated the risk of lithium-ion battery cell failure as less than 1 in 10 million, Sakti noted, with others pegging it as 1 in 40 million.

But high-profile examples gave cause for concern. A spate of grid battery fires in South Korea in 2018 might have dampened the enthusiasm, though they didn’t get much play in U.S. media. A more dramatic warning erupted in April 2019, when a grid battery installation outside Phoenix started smoking and eventually exploded. The blast sent four emergency responders to the hospital; it threw one of them 73 feet through a fence.

It’s not clear if NMC batteries have caused injuries in homes. But LG Chem’s recall notice confirmed that the threat of battery fires in homes is real, however rare or unlikely it may be. Automaker GM also recalled 68,667 cars with LG Chem batteries last year, after some of them caught fire. (Further reading: GTM investigated what battery developers did to prevent a repeat of the storage facility explosion in Arizona.)

LFP catches up

Meanwhile, LFP has steadily gained traction with customers.

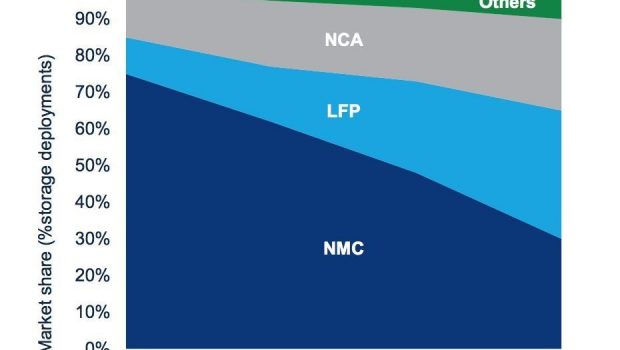

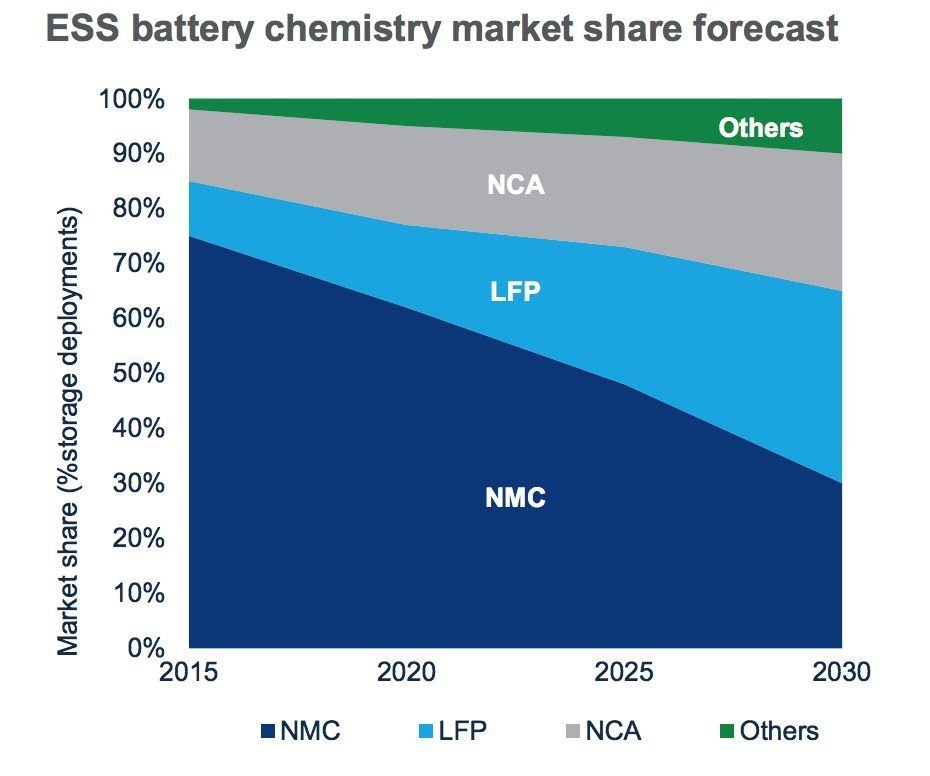

In 2015, LFP batteries only served 10 percent of the grid storage market, according to research from Wood Mackenzie. NMC dominated, with more than 70 percent market share. But since then, NMC’s market share has trended down while LFP’s rose. Analysts predict LFP will become the leading chemistry for grid batteries by 2030, with 30 percent of an increasingly diversified market.

The momentum shifted in 2018, when a lucrative storage incentive in South Korea, home of leading manufacturers LG Chem and Samsung, kicked off a battery installation bonanza.

“When the South Korea market boomed, there was a shortage in the energy storage market globally because the South Korean vendors were satisfying the domestic market,” said Mitalee Gupta, the WoodMac analyst who wrote the report on LFP’s rise.

After clear leadership in the stationary energy storage market, NMC will lose its edge as LFP gains ground, according to Gupta’s analysis. (Source: Wood Mackenzie)

At that point, U.S. storage companies looked to China, where manufacturers like CATL and BYD had been building LFP batteries for years. Western buyers increasingly decided those products stood up to scrutiny.

“LFP production is very mature and well developed in China,” said Shirley Meng, a materials scientist and professor who runs the Laboratory for Energy Storage and Conversion at U.C. San Diego. “The U.S. really needs to think about, are we going to reinvent the wheel here, or accept batteries produced there?”

One of the few companies manufacturing such batteries in the U.S. is SimpliPhi Power, based in the coastal city of Oxnard, Calif. The company got its start supplying Hollywood film productions, and later the military, with off-grid battery power. That required rugged technology that could stand up to heat and wouldn’t endanger cast and crew. Staff tested “every chemistry available” and “every form factor” and decided to produce LFP, Von Burg said.

“You can say that cobalt batteries are more energy-dense, but the truth is you can’t use the energy in the same robust way as you can with LFP,” Von Burg noted. “There’s a lot in the performance profile that cuts away and erodes the cost benefit.”

SimpliPhi was willing to accept the premium for the safety features, early on. Since then, the price of LFP has dropped significantly, Von Burg said: “It’s beginning to achieve that economy of scale that the cobalt manufacturers achieved years earlier.” The company doesn’t disclose its cell production capacity, but said it experienced a compound annual growth rate of 66 percent between 2016 and 2020.

ElectrIQ considers both chemistries to be safe, but switched from NMC to LFP for its third generation home battery product, launched in December, Saunders said.

“The price has gone down and the density has gone up,” he said. “The past issues have been resolved, and the safety takes it a step up.”

Finding the right chemistry

The more extravagant claims about LFP cast it as an indestructible alternative to a toxic, dangerous product. But Gupta, who studies storage supply chains, cautioned that LFP batteries are not immune to failure.

“They all have a fire risk because they contain an electrolyte which is flammable,” she said. Plus, safety depends on how well a system is installed, and the quality of the equipment that the battery cells plug into.

LG’s Tran echoed that point.

“I would say to any homeowner what I’ve been saying since we launched this battery product: Make sure your battery installer is certified,” she said.

A key benefit of LFP, though, is that if a cell fails, it doesn’t heat up as much as a failing NMC cell, which makes it harder for an LFP meltdown to spread. But the physical differences haven’t swayed consumers en masse.

Hawaii-based Blue Planet Energy chose LFP after founder and Tetris mogul Henk Rogers tried the technology out on his own home. One of the challenges in selling that chemistry, said Blue Planet Energy CEO Chris Johnson, is the need to educate customers on the fundamental differences between chemistries. Meanwhile, “major consumer brands” put their “vast resources” to work convincing consumers to buy NMC.

“We must, as an industry, be proactive in getting in front of safety concerns now as the industry ramps,” Johnson said.

There’s also a more nuanced conversation to be had about battery pricing.

Upfront cost can’t be ignored. But LFP batteries deliver more lifetime energy throughput before they wear out, said Adam Gentner, vice president of sonnen, which exclusively sells LFP battery packs for homes. If a customer wants a battery “just for backup power to an out-building,” NMC may be fine for that infrequent use, Gentner said. But if the goal is to safely use the battery every day, to make use of solar power or make money by delivering services to the grid, LFP is the better pick.

“I expect that we’ll begin seeing the balance tip towards LFP in the coming year,” he said.

New technologies on the horizon

Some battery experts are looking for alternatives that go beyond LFP. UCSD battery expert Meng said LFP is “a good intermediate solution until we find the ultimate solution for home energy storage,” which would be a battery that lasts 20 years at a radically lower cost.

Entrepreneur Ryan Brown is trying to build nonflammable residential batteries using zinc and water with his Halifax-based startup, Salient Energy. The goal is to get cheaper than any lithium-ion competitors based on the lower costs of zinc as an active ingredient. Unlike other challengers to conventional batteries, this design uses the same roll-to-roll manufacturing techniques that coat electrodes in lithium-ion factories.

“There’s nothing in it that’s toxic; there’s nothing in that could possibly catch fire,” Brown said.

Salient has raised just $3 million and is working on building a pilot plant. Its products have a couple of years to go before they hit the market. But Salient can piggyback on the cost-cutting innovations in lithium-ion manufacturing, which makes setting up a factory far cheaper than if it were a radically different technology.

“We can’t bet the entirety of addressing climate change on one battery chemistry,” Brown said. “We’re going to need something other than lithium.”

The influx of new players and chemistries is part of the maturation process for a market still dominated by two early movers.

“If you have more battery types in the market, that makes more competition and that makes the market grow,” Tran said.

***

For more energy storage insights, follow Julian on Twitter and subscribe to his free weekly newsletter, Bright Ideas.