Schneider Electric Unveils the Energy Center for Distributed-Energy-Enabled Homes

Schneider Electric Unveils the Energy Center for Distributed-Energy-Enabled Homes

Homes need a lot more digital smarts nowadays to manage rooftop solar, backup batteries and electric vehicle chargers. It’s nice if those distributed energy resources (DERs) can be integrated with household electrical load controls via smartphone or Alexa or Google voice-activated devices.

Then there’s the need to optimize these DERs and loads against utility time-of-use rates, net-metering tariffs and EV charging rate structures. And in worst-case scenarios, homeowners want to keep critical loads powered via battery or backup generator during outages that can last for hours or days at a time.

This mix of future-forward list of home energy control capabilities is increasingly in demand in markets including California, the epicenter of both DER deployment and wildfire-prevention grid outages. And while mass-market home electrical equipment tends to be optimized for low cost and reliability, both startups and global vendors alike are starting to see an opportunity to upsell contractors and homeowners on integrated systems that can take on all of these tasks at once.

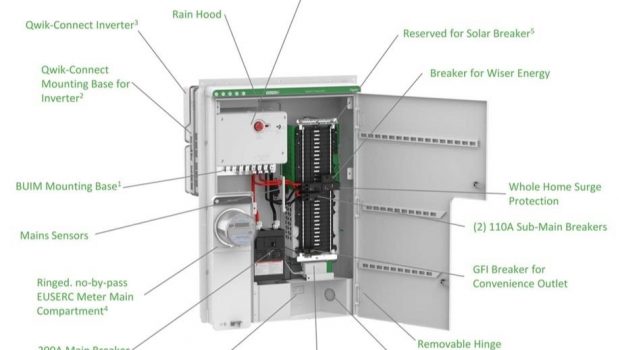

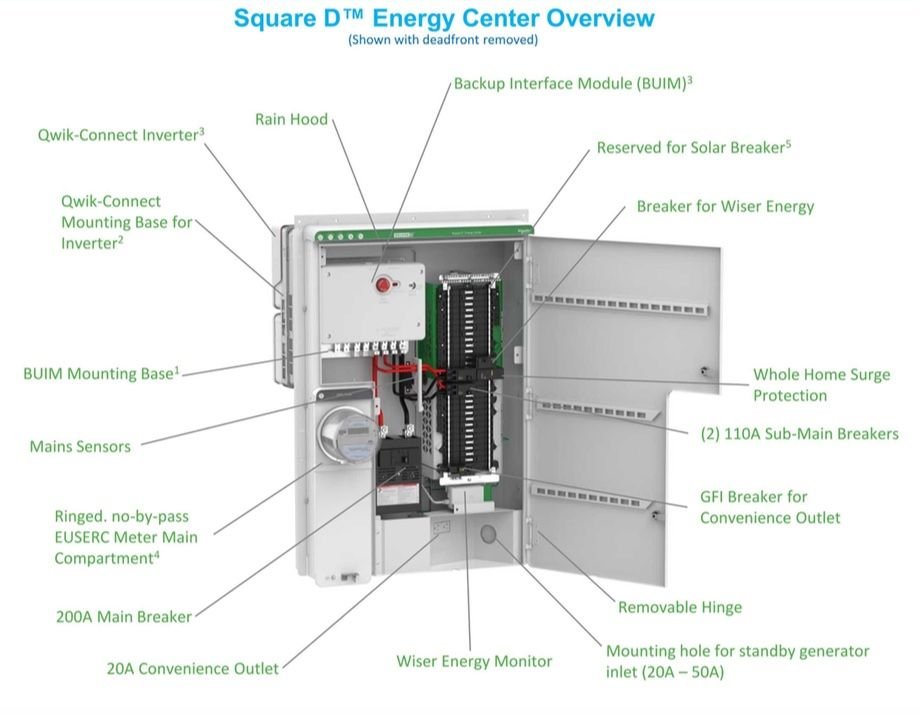

The most recent example is Schneider Electric’s latest Square D Energy Center, which is being unveiled at this week’s Consumer Electronics Show (CES) in Las Vegas. Set to be available in mid-2021, it combines the features of what would normally be six or seven separate equipment installations into one electrical service entrance box, integrated via Schneider’s Wiser energy control platform.

This is far from the first entry into “smart home” technology for Schneider Electric, whose Square D electrical distribution equipment brand holds significant market share in the residential and commercial building markets. Wiser has been around for nearly a decade, entering homes both through utility programs and via partnerships with home automation providers like Alarm.com.

But the latest product may be better poised for mass-market adoption than the previous iterations of smart home systems that have largely remained the stuff of CES showrooms and ultra-wealthy homeowner installations for the past decade or more.

The building blocks of the smart, distributed energy-enabled home

One key driver in this new market paradigm is the massive success of voice-activated devices, namely the Amazon Alexa and Google Assistant, which Wood Mackenzie predicts will be the go-to platform for home energy control integration over the next decade.

All of the top homebuilders in the U.S. are including these systems more or less as a matter of course nowadays, Richard Korthauer, vice president of Schneider’s home and distribution business, said in an interview. “This is something that’s allowing Schneider to launch into the whole connected environment.”

Another shift is the rising demand for rooftop solar systems equipped with batteries, both to shift solar-generated energy to more valuable times of the day and to provide emergency backup power, he said.

These installations often require replacing older electrical panels anyway, giving contractors and homeowners a reason to spend extra money on newer technology that can skip the need for costly extra equipment and hours of work from licensed electricians.

In particular, the system is configured to allow wiring-free installation of the popular SolarEdge solar inverter system — “It’s literally taking the unit, putting it on a hanger and plugging it in.”

The interior of Schneider Electric’s new integrated electrical panel. (Credit: Schneider Electric)

Giving customers the ability to pick critical and noncritical loads to power during outages on the fly also increases flexibility and reduces costs involved in setting up systems to provide backup power, such as installing switches for preselected hard-wired loads.

What’s more, Schneider’s platform integrates energy disaggregation from Sense, which can differentiate household loads down to the individual appliance. That allows the Square D Energy Center to measure energy use against home solar generation and stored battery power, and to know how long they can keep certain loads running depending on how long the outage is expected to last.

“If you’re a homeowner and you have to deal with planned blackouts, this is a real enabler — first of all to pick your alternative energy source, and then to let our system match the power requirements you need,” Korthauer said.

Energy disaggregation comes in many different flavors with different levels of granularity and does require some time to learn the signatures of different household loads to deliver accurate and reliable data. But two years after investing in and launching a strategic partnership with Sense, Schneider has figured it out.

“I’ve had it installed in my home, and in a matter of weeks, I had my heating and air conditioning [in the system]. I had my critical energy loads [figured out] pretty quickly, and I also understood my random loads,” he said.

Electric vehicles add another important load to manage, with charging that can add up to a third to a half of a typical home’s electricity demand.

Increasing competition in-home energy controls

The same drivers have pushed a host of technology providers to take the leap into more expensive products that could promise to save money compared to traditional “dumb” electronic equipment over the long haul.

Many different solar and storage vendors, including Tesla, Sunrun, sonnen, Generac and Enphase, are offering energy control platforms that are adding sophistication to manage time-of-use rates and visibility into demand-supply balance during blackouts. Some are integrating energy disaggregation, as with Generac’s acquisition of Vancouver, Canada-based startup Neurio last year.

Startup Lumin makes hardware that integrates into electrical panels and software to give homeowners visibility into and control over battery power supply and household load demand, and it is being used by numerous solar and storage installers.

Span, a San Francisco-based startup founded by Tesla alum Arch Rao, makes a smart home electrical panel that offers smartphone monitoring control over critical and noncritical loads, as well as machine learning to manage rooftop solar and battery supply against household demand. It’s partnering with battery supplier LG Chem and solar installers in Hawaii and California.

Eaton, one of Schneider’s primary global competitors in the distribution electronics field, has been testing cloud-connected circuit breakers in field trials with the Electric Power Research Association for the past few years, and has integrated them into commercially available products such as sonnen’s EcoLinx home automation platform.

All of this increased capability comes at a price, of course. But while Schneider hasn’t released pricing details on the Square D Energy Center, Korthauer said its upfront cost will be well below the cost of putting together its range of functionalities by integrating separate technologies.

“You’re going to pick up the ability to do distributed energy, energy monitoring via the Wiser app [and] the ability to automatically switch loads, and you’re going to be adding literally only $1,000 to your initial investment,” he said.