Rooftop solar skyrockets if an alternative to monopoly utility models is employed –

Rooftop solar skyrockets if an alternative to monopoly utility models is employed –

Originally published on ILSR.org

Since rooftop solar became possible, electric utilities have struggled to incorporate it into their outdated business model. In recent years, this lag in utility recognition has become increasingly problematic, risking the health, environmental, and financial impacts of over-investment in large fossil fuel power plants. In over 30 states, monopoly utilities submit plans for new power plants to public regulators without adequately considering how customers will serve themselves.

However, a new modeling approach from Vote Solar and the Institute for Local Self-Reliance (ILSR) might finally put distributed solar on the same footing in grid planning as the large power plants that utilities prefer. Our method, first filed in a resource plan in early 2021 for Minnesota-based Xcel Energy, showed that the utility could cost-effectively add nearly 2,000 megawatts more distributed solar than it plans to, saving customers billions of dollars. Expanded to other regions and utilities, these findings underline the importance of accurately assessing the potential of customer-sited solar in utility planning.

The Shortcomings of the Current Approach to Modeling Rooftop Solar

Utilities typically account for rooftop solar in the planning process in the same ad hoc way they approached billing for the first solar systems connected to the grid decades ago. When the first solar arrays were installed at homes, it made electric meters — as unprepared as the utility that owned them — run backward. Some electric utilities and then state governments adopted “net metering” policies to account for the electricity customers produced for themselves.

In grid planning, utilities still treat rooftop solar as unexpected. Typically, they make a poor estimate (as in half-hearted and too low) of customer adoption of solar and treat it as reduction in electricity demand. They also hide this poor estimate in a black box called “trade secret,” a designation that prevents most people from reviewing the assumptions or calculations without signing a non-disclosure agreement. To meet the remaining supply, utilities use software to model which big power plants they’ll purchase to serve the need. The result is plans that have two shortcomings. First, they underestimate solar adoption. Second, they ignore the financial truth that customer-owned solar can compete with utility-scale solar on price, because customers pay the capital costs and distributed solar provides more value to the grid than centralized solar power plants.

Making a Better Rooftop Solar Model

In comments filed on the Xcel Energy resource plan in Minnesota, ILSR and Vote Solar (along with Cooperative Energy Futures) suggested solutions to both of these utility planning shortcomings.

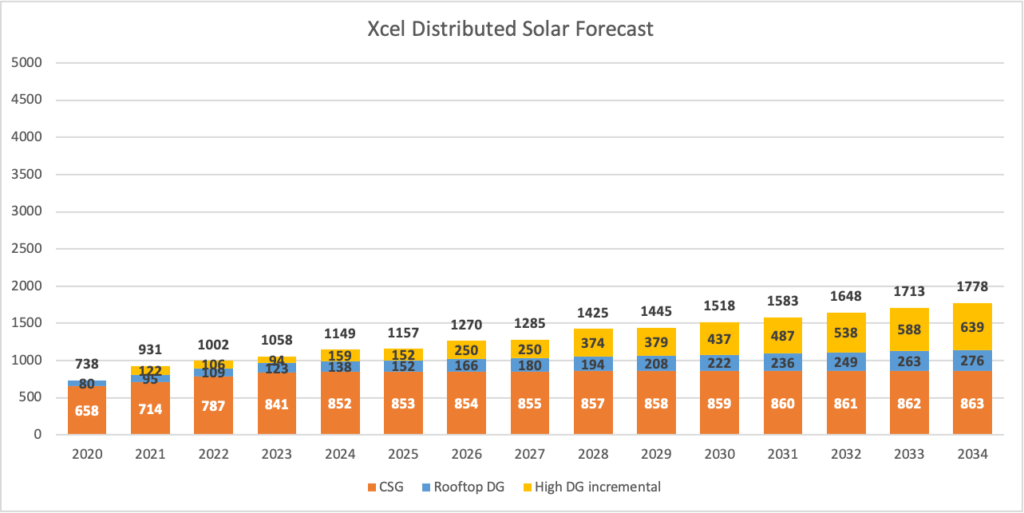

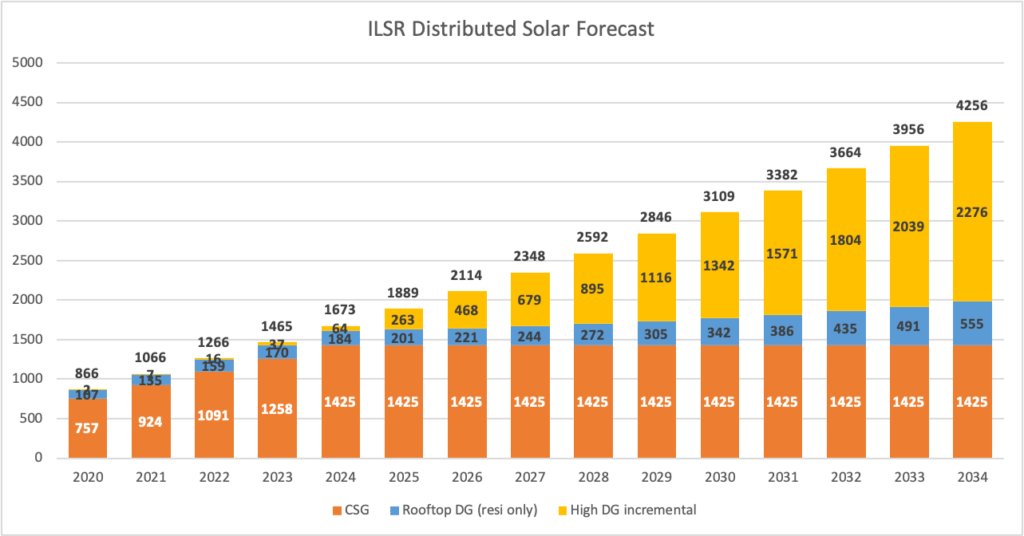

To the issue of distributed solar forecasting, ILSR adapted a recently developed residential solar adoption model published in Renewable Energy for Xcel’s service territory. It showed that solar adoption by Xcel Energy customers — on customer rooftops — was likely to proceed much more quickly than the utility predicted. The following charts show Xcel’s original forecast (with a total of 1,778 megawatts of distributed solar by 2034) and ILSR’s modeled forecast of 4,256 megawatts of distributed solar. ILSR also forecast community solar, but using a different method. In the chart, CSG refers to “community solar gardens,” Rooftop DG refers to rooftop “distributed generation,” and High DG to Xcel’s “High Distributed Generation” forecast.

To the issue of comparing distributed solar costs to other power sources, Vote Solar and ILSR proposed an innovative approach of modeling distributed solar along with utility-scale solar (instead of treating distributed solar as demand reduction and utility-scale solar as supply).

Typically, when utilities model new power plant acquisition, they price utility-scale solar at approximately three cents per kilowatt-hour and distributed solar at the retail electricity rate, perhaps twelve cents per kilowatt-hour. This is comparing apples to oranges because the utility-scale solar price doesn’t include transmission and delivery costs to reach consumers, whereas the distributed solar (placed right next to customers) does.

Additionally, comparing the two types of solar on their cost to generate electricity at the point of generation ignores the value of distributed solar to the utility. In Minnesota, helpfully, Xcel Energy is required by state law and public regulators to file an annual value of solar calculation. This calculation includes costs that are avoided when a customer produces clean solar energy for the utility, from fuel and maintenance savings at power plants to avoided pollution. The 2020 value of solar was just over 11 cents per kilowatt-hour, about the same as the utility’s retail electricity price, suggesting distributed solar is essentially net zero cost.

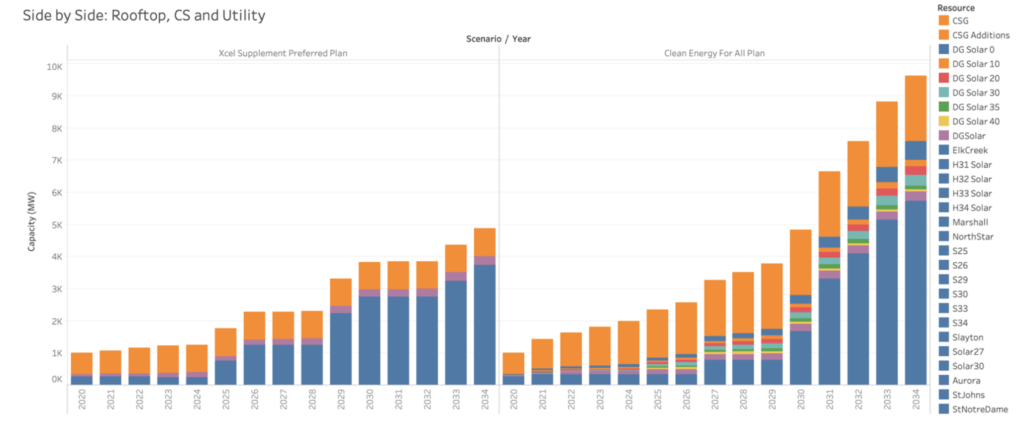

To improve upon Xcel’s flawed analysis of distributed solar, Vote Solar and ILSR modeled distributed solar acquisition given various levels of performance incentives from the utility. As noted above, distributed solar is assumed to have essentially zero cost to the utility if the bill credits from net metering are similar to the value of solar. Thus, the true cost of distributed solar to the utility and its customers is what additional price the utility pays. If the utility paid distributed solar projects two cents per kilowatt-hour produced, for example, it would still cost less than utility-scale solar (three cents) and result in more solar capacity. Our model found the utility could cost-effectively add almost 2,000 megawatts more distributed, customer-sited solar than it had originally forecast. The following chart compares the Xcel filed plan (left) with the Sierra Club Clean Energy for All plan based on the modeling assumptions supplied by Vote Solar and ILSR (right). The “DG Solar” items show the utility acquisition of distributed solar at various per-megawatt hour price points (e.g. DG Solar 10 is distributed solar purchased at $10 per megawatt-hour or 1 cent per kilowatt-hour). Other chart items include CSG (community solar gardens), and a variety of utility-scale solar projects.

Big Savings from More Rooftop Solar

In addition to this model projecting far more distributed solar, it saves customers money. The entire package of electricity resources modeled by Sierra Club saves nearly $2 billion compared to the utility’s preferred plan. It also provides direct bill savings to thousands of residents and businesses that host distributed solar arrays. This aligns with findings from the recent Vibrant Clean Energy study that shows nearly half a trillion dollars in savings from accelerating distributed energy in national decarbonization efforts, as well as their earlier Smarter Grid Study in Minnesota showing that adopting close to 13,000 megawatts of distributed solar generates more jobs and bill savings than nearly any other scenario for a low-carbon electric grid.

Utility regulators in other states should take note of this finding and the probable utility response. Xcel Energy is unlikely to favor the alternative Clean Energy for All plan, for the primary reason that its shareholders do not earn a rate of return on customer-sited solar as they do with utility-scale, utility-owned solar. This conflict of interest between the utility’s customers and its investors plagues most investor-owned utilities because market rules reward them more for spending our money on things they own.

The one caveat in Vote Solar and ILSR’s analysis is that the value of solar is not fixed. Xcel’s value of solar currently shows that the utility and its customers are effectively neutral toward distributed solar, because the value of solar and the retail electricity price are near parity. Over time, however, the value of distributed solar can change based on the fuels it replaces, the carbon intensity of the grid, and the amount of distributed solar on the grid system. In other words, this model is better than undercounting distributed solar or ignoring it, but it also requires careful consideration.

The big picture is that dozens of large, investor-owned utilities have made bold public commitments to reduce carbon emissions, but aren’t acting quickly enough to meet their own pledges. Customer-sited solar can provide some of the least expensive electricity to serve these goals. When public regulators in Georgia, Florida, New Mexico, Colorado, and elsewhere start asking how utilities plan to meet their climate goals, distributed solar should be at the top of the list.