Behind-the-Meter Battery Pioneer Stem to Take SPAC Route to Public Markets

Behind-the-Meter Battery Pioneer Stem to Take SPAC Route to Public Markets

Stem, the decade-old behind-the-meter battery startup that was seeking a buyer earlier this year to bolster its growth ambitions, is now launching a plan to go public via a special purpose acquisition corporation (SPAC) reverse merger.

Friday’s announcement names Star Peak Energy Transition Corp. as the SPAC that will enable Stem’s capital needs. The transaction is expected to raise $608 million in gross proceeds, including Star Peak’s $383 million of cash held in trust and $225 million in a private investment in public equity (PIPE) commitment from funds and accounts managed by BlackRock, Van Eck Associates Corporation, Adage Capital Management, L.P., Electron Capital Partners, and Senator Investment Group.

If the transaction closes in the first quarter of 2021 as expected, it will create a company with an equity value of about $1.35 billion, listed on the New York Stock Exchange under the ticker symbol STEM. That will allow the company to expand its existing markets in the U.S., Japan and Canada, as well as target growth in Europe and other regions, CEO John Carrington said in a Friday interview.

With the new funding, “we’ll have the ability to go after larger projects,” he said. “We’ll have the ability to expand our Athena platform,” the software that’s playing an increasing role in Stem’s behind-the-meter and front-of-meter storage business. “And we’ll be able to look at some tech acquisitions” to address an increasingly complex and competitive energy storage market.

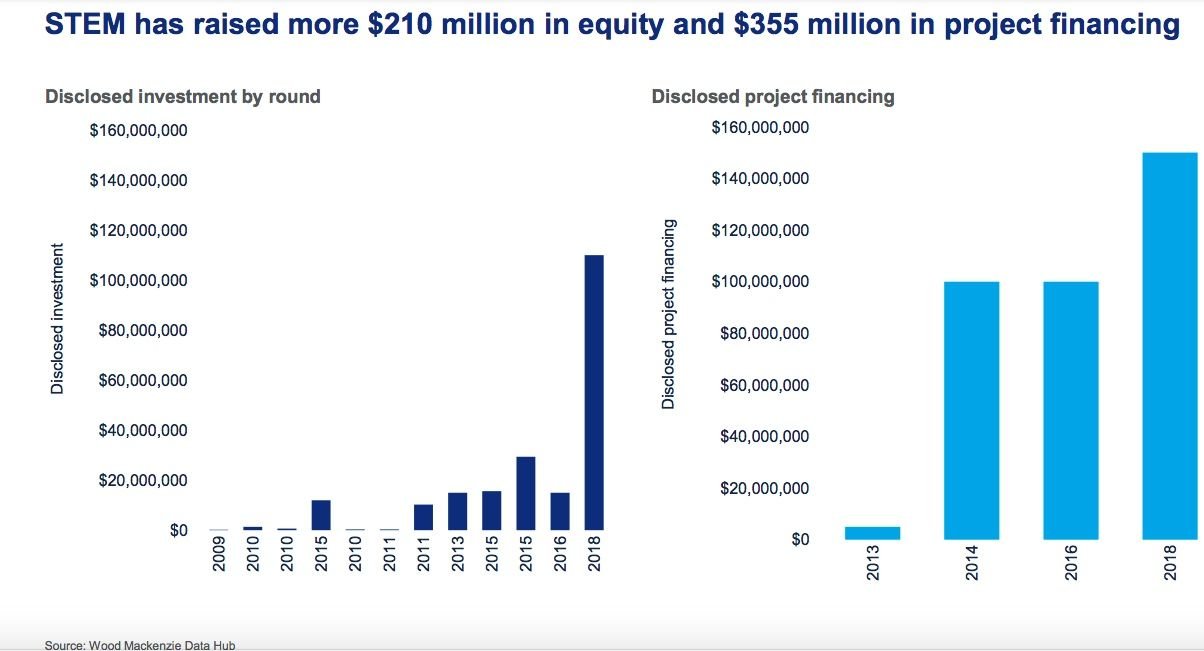

Stem is one of the last pure-play energy storage startups, and has raised about $210 million in equity investment over the years, culminating in a 2018 Series D for $106 million. It’s also raised roughly $355 million in project financing.

By going public, it’s hoping to boost capital available to fund a pipeline of projects that has grown from $1.2 billion in late 2019 to about $2.7 billion in the third quarter of 2020. According to its Friday investor presentation, Stem expects to reach profitability on an EBIDTA basis by 2022 and becoming free cash flow positive by 2023.

The SPAC model has become an enormously popular way for green technology startups to access public markets to finance growth in fast-growing markets, led by a host of electric vehicle startups including Nikola Motor and Fisker Automotive, EV charging providers ChargePoint and Nuvve, and battery manufacturer Eos Energy Storage.

Stem’s business of providing battery systems and software and services to store and shift renewable energy, provide backup power and shape building loads to optimize utility bills is tapping into a market growing at a record pace in the U.S. and abroad. U.S. storage installations broke yet another record in the third quarter of 2020 with 476 megawatts installed, according to the latest Energy Storage Monitor from Wood Mackenzie and the Energy Storage Association.

But as the market grows, so does the competition amongst providers of battery systems, software platforms to manage their performance, and financing options to reduce the up-front costs for customers looking to install them. Beyond well-known battery providers like Tesla and Fluence, deep-pocketed European energy giants Enel, Engie, Shell and Total are backing the behind-the-meter battery companies they’ve acquired. Partnerships like those between Siemens and Macquarie and Schneider Electric and Huck Capital are funneling financing to commercial and industrial customers seeking low-cost distributed energy.

Stem’s role in opening the behind-the-meter battery market

In that light, “it was pretty obvious that Stem had to go public in one way or another,” Elta Kolo, content lead for Wood Mackenzie’s Grid Edge team, said in a Friday interview. “Anything that involves hardware and manufacturing makes it hard to get the capital they need from traditional venture capital.”

Stem was founded in 2009 as power electronics startup Powergetics, and rebranded as Stem in 2012, becoming one of the first pure-play providers of batteries to help building owners and operators shave peak demand usage and cut back on their utility bills.

It won early customers in California, aided by high demand charges for commercial buildings and a friendly regulatory environment, including the state’s Self-Generation Incentive Program (SGIP) for behind-the-meter batteries. Stem has won hefty incentives from SGIP, but also saw its participation push it into controversy in 2015 and 2016, when it returned some of the funds it received after accusations of gaming the lottery system for securing them.

Stem also scored a coup in 2013 with an 85-megawatt contract with Southern California Edison as part of the utility’s first large-scale procurement of distributed energy resources to help replace grid capacity lost with the closure of the San Onofre nuclear power plant. It has also taken over management of the battery portfolio developed by another SCE contract winner, AMS (formerly Advanced Microgrid Solutions), which was recently acquired by energy storage integration heavyweight Fluence.

AMS’s acquisition has left Stem as one of the few standalone storage startups that’s remained independent over the past decade. New York-based rival Green Charge Network was acquired by Engie in 2016, The next year, Demand Energy was bought by Enel and German-based Younicos was acquired by Aggreko.

Stem’s future model: software-centric, with a growing front-of-meter business

Stem has also been shifting from its early go-to-market model of owning the batteries, software, services and contracts for these behind-the-meter projects, as competition has grown and market opportunities outside California have lagged behind expectation.

Instead, it’s refocused on providing its software platform, dubbed Athena, to customers and project developers looking to optimize the mix of batteries and other behind-the-meter resources against a complex set of energy bill cost-cutting and energy market revenue-generation opportunities.

Stem revealed last year that it laid off less than 10 percent of its workforce as it made the shift to a software-centric approach working with projects partners to gain new customers. But “our Athena platform is really taking hold,” Carrington said, bolstering its deal with Swiss infrastructure fund manager SUSI Partners and South Korean power producer SK E&S to take over AMS’s Southern California portfolio, and expanding opportunities in new markets.

WoodMac’s Kolo warned that this capital-light approach still needs to contend with the need for financing to bolster the business case for commercial-industrial behind-the-meter battery installations. “Even though they said they’re going to a capital-light approach, you need to get these assets in the ground — and C&I customers are a very tough market.”

“Our original model really included much more project finance,” Carrington said in Friday’s interview. But with the shift to working with partners, “our big solar plus storage developers are using their own finance. We’ll sell a highly integrated hardware package, with software sales, 10 to 20 year contracts […] the financing piece is becoming less significant.”

While utility-scale storage and residential energy storage has been growing rapidly, commercial-scale behind-the-meter storage has been relatively flat, with more cost-conscious customers and a checkered set of utility and regulatory conditions for making these kinds of projects pencil out. Stem launched its first front-of-meter, distribution grid connected projects last year, and expects them to account for roughly half of its business by 2023, Carrington said. At the same time, the company forecasts that behind-the-meter C&I storage will grow more quickly in the coming years, as corporate cusotmers committing to clean energy seek ways to balance on-site solar with batteries, and as regulators increase support for batteries as “the holy grail of expanding renewables,” he said.

Likewise, pure-play software approaches to the behind-the-meter energy storage offerings are contending in an increasingly consolidated landscape, Kolo said. On the battery management software front, Greensmith was acquired by Wartsila in 2017, and Geli was acquired by Hanwha Q Cells this summer. Similarly, virtual power plant software and services provider Enbala was acquired by Generac in October.

Behind-the-meter batteries are increasingly being put in place not only to mitigate demand charges, but to store and shift distributed solar to increase its value, and to provide emergency backup power in microgrid formations.

“Stem’s strategic refocus on software is a big bet that maximizing storage’s value will become a critical need to capture disparate revenue,” Daniel Finn-Foley, energy storage director at Wood Mackenzie, said in a Friday email. “This will be a good data point on how much the market agrees with this prediction.”